will the irs forgive my debt

Offer in Compromise OIC An Offer in Compromise is an agreement in which the IRS accepts a lesser offer amount than the total back taxes amount. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married.

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

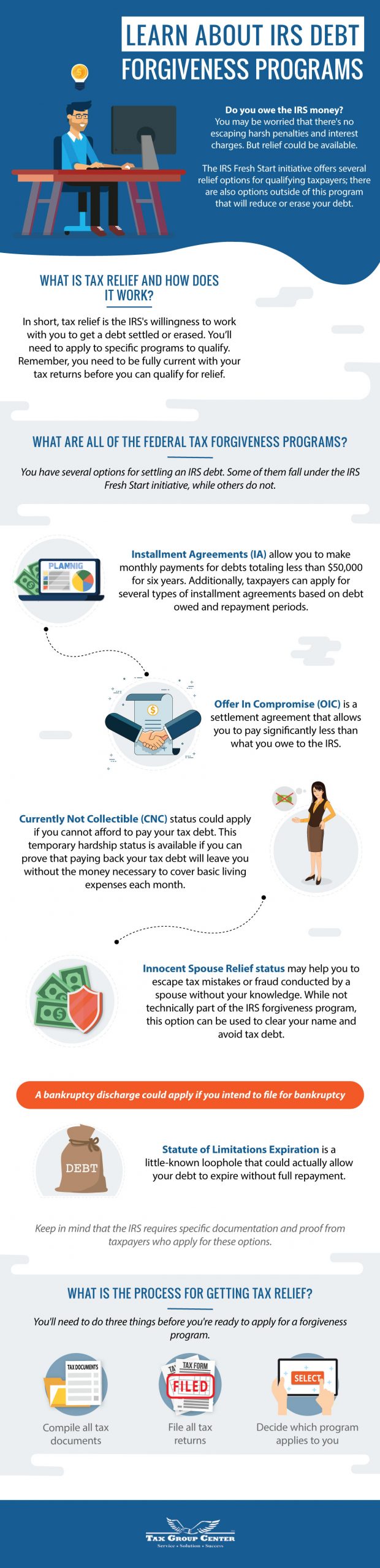

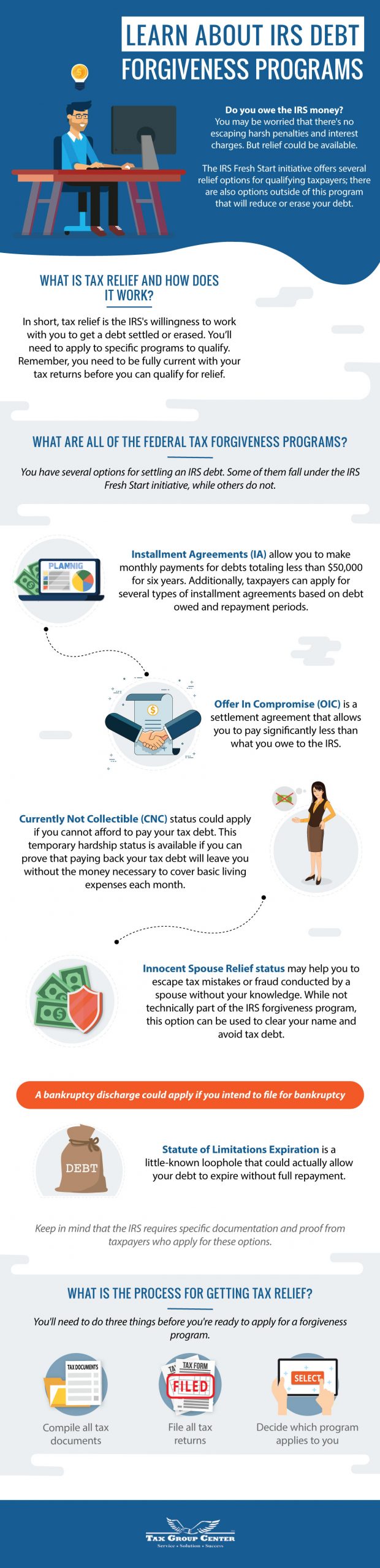

While total tax debt forgiveness is a bit of a myth there ARE relief options you can use to reduce or eliminate your liability on.

. You have convinced the. Under the Offer in Compromise program you settle your case for less than you. Ad Need a dedicated lawyer to navigate Ch.

Understand why the IRS is saying you owe and whether you agree with it. Ad End Your IRS Tax Problems. BBB Accredited A Rating - Free Consult.

485 66 votes It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with. 5 Best Tax Relief Companies 2022. The IRS will automatically add certain new tax balances to existing installment agreements for individuals and for business taxpayers who have gone out of business.

If you have a tax debt with the IRS you may be eligible for one-time forgiveness and have either your taxes or your penalties forgiven. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. The What Ifs for Struggling Taxpayers.

Our dedicated team will find the right solution for you. Ad End Your IRS Tax Problems. 1 Low Monthly Payment.

The Realists Guide to IRS Tax Debt Forgiveness. The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. An Offer in Compromise OIC is an agreement whereby the IRS agrees to settle your tax debt for less than the full amount owedsometimes for a tiny.

To be eligible for installment agreements one has to owe less than 50000 in income taxes interest and penalties combined. Some of your tax debt will end up being forgiven and youll no longer need to make payments. IRS Tax Debt Forgiveness.

If you havent already read our 5 steps to. Does the IRS forgive tax debt after 10 years. This means the IRS should.

Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. 3 Reasons the IRS May Accept an Offer in Compromise. Frost Law is here to help.

The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. What to know before you ask for IRS tax debt forgiveness.

The tax that applies to an increase on investments held more than 12. If you owe a substantial amount of. BBB Accredited A Rating - Free Consult.

2 days agoBiden has suggested that he would support canceling up to 10000 per person while excluding wealthier borrowers but we dont know exactly what it would look like if he forgives. Generally if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include the cancelled amount in income for tax. PPIAs are generally an option when you can afford to make monthly payments but you cant.

The IRS has 10. Ad You Dont Have to Face the IRS Alone. 445 35 votes It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with.

The Mortgage Forgiveness Debt Relief Act of 2007 includes the cancelation of the complete debt. Get expert guidance and get prequalified for an IRS Tax Forgiveness Program. There are three reasons the IRS may approve an Offer in Compromise.

Do you have complicated debt. Ad Tax forgiveness experts are ready to help you leave your tax issues behind. End Your Tax NightApre Now.

1 Low Monthly Payment. If the mortgage terms were renegotiated up to 2 million of forgiven debt is. After that the debt is wiped clean from.

Time Limits on the IRS Collection Process. The IRS Debt Forgiveness Program presents taxpayers with several options to catch up on their unpaid taxes. That was the first book ever written for the public that exposed the right to discharge taxes in bankruptcy.

Get the Help You Need from Top Tax Relief Companies. They should also have filed past and current. People facing financial difficulties may find that theres a tax impact to events such as job loss debt forgiveness or tapping a.

3 hours agoThese are taxed at the higher rates 10 12 22 24 32 35 or 37. IRS debt relief is for those with a debt of 50000 or less.

Does Irs Debt Show On Your Credit Report H R Block

Irs Debt Forgiveness Usa Tax Settlement

Irs Tax Debt Forgiveness Tax Debt Debt Forgiveness Tax Debt Relief

What Is Irs Form 1099 C Cancellation Of Debt

Tax Debt Settlement Everything You Must Know On Irs Tax Settlement Firms Blog

Pdf Download How To Get Tax Amnesty By Daniel J Pilla Free Epub Free Ebooks Download Pdf Download Tax Debt

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form

Liens And Levies Md Va Pa Strategic Tax Resolution Tax Debt Debt Relief Irs Taxes

Irs Tax Debt Relief Forgiveness On Taxes

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

7015 Optima Tax Relief Lettering Take You Home Relief

Tax Debt Relief Things You Need To Know Tax Relief Center Tax Debt Tax Debt Relief Debt Relief

Epub Free Lower Your Taxes Big Time 20192020 Small Business Wealth Building And Tax Reduction Secrets F Tax Reduction Small Business Tax Mcgraw Hill Education